ON-DEMAND WEBINAR

The Art of the Exit in PE:

Navigating Timing, Strategies, and Deal Structuring for Maximum Returns in 2024

Private equity exits reached a record low in 2023, down 64% from their peak in 2021*, as PE investors struggled to offload portfolio companies in an unstable market. Yet, 2024 holds promise with an abundance of aging deals offering vast value creation potential for both buyers and sellers.

Watch this panel discussion where we explore this defining trend in further detail. Join us to delve into the different exit strategies and how deal structuring affects exit outcomes and returns. Oliver Parker (Alantra) shares his perspective and expertise on determining the optimal timing for exiting investments as well as managing potential challenges and risks during the exit process and more. The discussion is further enriched by Christian Nentwich (Duco), who brings invaluable firsthand experience, having successfully exited from VC to a PE fund. His unique perspective sheds light on the intricacies of navigating the exit process from the founder's standpoint, offering insights on aligning interests, managing negotiations, and maximizing value creation.

The event is hosted by Arbolus CEO and Co-founder Sam Glasswell.

*Pitchbook, 2023 Annual US PE Breakdown

Who will you hear from?

Oliver Parker

Partner, Software and Tech Services at Alantra

Oliver Parker is a partner at Alantra’s Technology team with a focus on software and IT services. With more than 15 years of M&A experience across the technology sector he’s worked on over 40 transactions for clients in the UK and across Europe.

Oliver joined Alantra from Arma Partners and prior to that, he was a member of the technology team at William Blair.

Christian Nentwich

Founder and Board Member, Duco

A lifelong technologist with a relentless passion for simplifying complex data using augmented machine learning and AI automation, he launched Duco to help people dealing with mission critical data on a daily basis.

Christian is recognised for building companies with a strong focus on culture and transparency that deliver transformational experiences to customers. Prior to Duco, he founded Systemwire, which exited to Message Automation and further to Broadridge.

Why should you watch?

- Value Creation Opportunities: Learn about leveraging relationships and networks to identify potential buyers and maximize exit value.

- Insightful Analysis: Identify the factors that led to the record low in 2023 and acquire key insights into the current situation of private equity exits.

- Exited founder perspective: Explore how to navigate founder expectations, concerns and considerations when planning your exit strategy.

About us

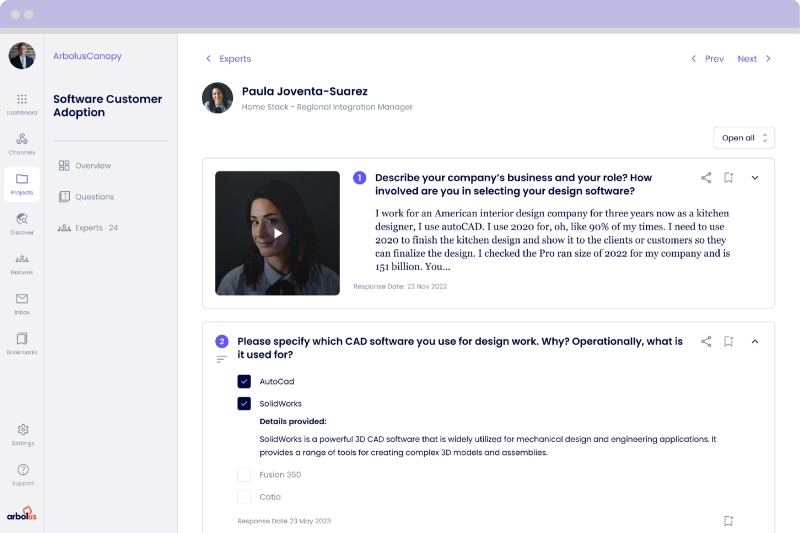

Fewer Calls. Better Insights. Faster

Arbolus is the go-to expert network for Investors and Consultants seeking a forward-thinking way to gain an information advantage.

Enabled by our tech-driven approach, we deliver better insights, from the best experts, in less time with innovative products, the most relevant, hard-to-find experts and a dedicated team you can rely on.